Disclosure: I receive NO compensation from credit card affiliate partnerships. Support the blog by applying for a card through my personal referral links.

A few weeks back, I wrote about how the Amex Platinum card wasn’t necessarily worth the annual fee. If you look at the reasons cited in this post, I outlined how using the Airline Fee Credit was a particular pain point for me. However, with the Hilton Aspire Card, I experimented a bit and it worked out. I was looking on maxing my credit out for the year and I got the entire $250 back!

Airline Fee Credit

This benefit is quite prevalent with many American Express cards. The fine print of the credit states that the following purchases do not qualify for the purpose of the credit:

Airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award tickets are not deemed to be incidental fees.

As per the fine print, this credit is supposedly an incidental credit for one or more of the following expenses with an airline:

- Checked baggage fees

- Itinerary change fees

- Phone reservation fees

- Seat assignment fees

- Inflight amenity fees

- Inflight entertainment fees (doesn’t include in-flight internet)

- Airport lounge day passes and Annual lounge memberships

- Inflight Pet fees

Cards offering the Airline Fee Credit Benefit

The following American Express Cards currently offer the Airline Fee Credit Benefit:

Amex Platinum Card (Personal)

Amex Platinum Card (Business)

Amex Gold Card

Hilton Aspire Card

Airline Credit Choice

Prior to booking the tickets, I looked up a few reports on Flyertalk in order to get some recent data points. While there were a few reports of successful reimbursements, the general consensus was that the entire deal was a YMMV situation. I decided to try it out and selected Alaska Airline as my airline choice in December.

Airline Tickets

If you carefully peruse some of the discussions on FlyerTalk, you’ll come across two sets of data points. Certain commenters point out that tickets under $50 trigger the credit. Some comment that even tickets under $100 get reimbursed. In order to test this out, I booked multiple one way tickets instead of booking round-trip tickets.

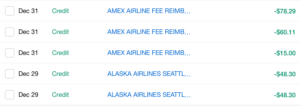

Within a few days, all of the purchases were reimbursed, to complete the total of $250 for the year. Out of the five purchases that I got the airline fee credit for, only one purchase was a seat assignment fee of $15.

Following were the five credits that I got: $48.30, $48.30, $78.29, $ 60.11 and $15.

Date of Purchase: 12/25 for the first two purchases, 12/26 for the remaining three

Date of Credit: 12/29 for the first two purchases, 12/31 for the remaining three

The Pundit’s Mantra

While you really have to find workarounds to maximize the airline fee credit, there’s one silver lining. The airline fee credit is offered per calendar year. I now have another $250 in airline fee credits to use for 2020.

With the airline fee credit benefit, it can always be a hit and miss scenario when you try to buy tickets with it. However, the great thing about this hobby is that until and unless you experiment on your own, you never really know what’s working and what isn’t. Data points on forums like FlyerTalk and Reddit can serve as a guideline, but you only know the outcome when you try it out by yourself.

Have you had success while trying to get the airline fee credited for expenses other that what Amex explicitly states in their terms and conditions? Have you had success doing something similar for a different airline? Let us know in the comments section.

Never miss out on the best miles/points deals. Like us on Facebook, follow us on Instagram and Twitter to keep getting the latest content!

Received credit today for Premium Economy seat (upgrade) charges on AA flights

That’s great! Glad you were able to use the credit.

I recently had two $97 tickets on Southwest get reimbursed on an Amex Platinum.

Great that it worked for you!

So we’re these flights that you actually needed? Or that u only booked to get the credit and then cancelled?

Hi ATT, yes, I booked these flights and actually took them. No cancellations or changes.

Dead in 3… 2… 1…

I doubt. This has been around for a while and there isn’t an exact science to exactly what triggers it, which is different from the gift card workarounds. Certain amounts for certain airlines trigger the credit sometimes, but often they don’t. These discussions have been around on Reddit and Flyertalk for years now. You don’t really know what works unless you actually charge something to your card.

Good job now amex will notice this and claw back and hopefully shut down your account also

LOL 🙂 Would be quite a stretch for Amex to start shutting down accounts of customers for buying flights on a travel credit card.