My current credit card strategy has me applying for 10-12 credit cards a year. With that many applications, you might think my attention is spread too thin among the bunch… Wrong!

I work hard to ensure that each potential credit card application is provided the same level of attention and thought. Issuing banks are getting tougher on approval for those who apply for a high number of cards. Accordingly, it is becoming more important that serious consideration be given to which card offers are worth an application.

Last week I decided to apply for the Barclaycard Arrival Plus. Let me tell you why…

Reason 1: The Card Fit My Strategy

Rule #1 of the AcCounting Your Points Starter Guide – Let your travel goals be your points and miles guide. Build your rewards strategy around the trips you want to take, rather than what may be “good deals” at the time. It’s a crucial point that will send you on the travel you want and will prevent you from accumulating points and miles for the sake of accumulating points and miles!

My travel goal?

Simple – Get from London to Tampa in January 2017

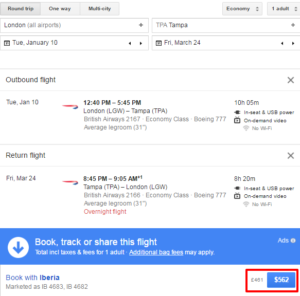

My choice route – British Airways Flight 2167 Non-stop London (LGW) to Tampa (TPA).

Note: The one way price was a ridiculous $1,628, so I decided to make it a round-trip flight returning in summer 2017 for just $562 total! Whether I take that flight return flight to London or not, the round-trip price is the clear choice.

Enter the Barclaycard Arrival Plus!

With an initial increased sign-up bonus of 50,000 Arrival Miles after $3,000 spending in the first 3 months of card ownership, I can cover most of the $562 round-trip airfare! And to sweeten the value of the proposition even more – the $89 annual fee is waived the first year.

Remember, Barclaycard Arrival Miles operate differently than your typical frequent flyer miles. The “miles” do not follow any airline award chart, but rather can be applied to travel expenses paid for with the Barclaycard Arrival Plus. They operate much more like reward points than the “miles” title suggests!

The 50,000 Arrival Miles are worth $500 in travel credit, and since this card earns 2x miles per $1, I’ll earn an additional 6,000 miles (worth $60) after meeting the $3,000 in minimum spend! Total that up and you have yourself $560 in travel credit in one credit card sign-up, not to mention the 5% rebate earned through the redemption of those miles.

Note: Barclaycard Arrival Miles must be redeemed in increments of 10,000 or $100, so with my flights detailed above I would not be able to redeem my Miles for the full $562 charge, but rather just $500.

This card isn’t a home-run hitter like the Chase Sapphire Reserve – and I don’t need it to be! (I have the Chase Sapphire Reserve for that!) Rather, the Barclaycard Arrival Plus should be considered a utility card, filling into your credit card line-up wherever a need exists!

Reason 2: The Previously Mentioned Increased Bonus Offer

The typical public offer on this card is 40,000 Arrival Miles after meeting the same spending requirements. A couple of years ago I applied for this card and ended up using the 40,000 bonus on a helicopter ride in Kauai!

The card terms suggest that I may not earn the bonus since I have had this card product in the past: “This one-time 50,000 miles offer is valid for first-time cardmembers with new accounts only. Existing cardmembers and existing accounts are not eligible for this offer.”

Luckily for me, the much trusted Doctor of Credit reports otherwise, suggesting that there is no limit to how many times one can receive the bonus on this card offer as long as you do not current hold the card… fingers crossed this is true!

While the card has lost some of its benefit value over time… like a lower 2,500 ($25) redemption minimum vs. the current 10,000 redemption minimum, or the former 10% rebate on miles vs. the current 5% rebate – I believe that the increase in sign-up bonus justifies another application.

Additionally, to revisit Reason 1 and the AYP Starter Guide, my goal with this application is to earn the bonus and almost $600 in travel credit. I acknowledge that this card does not offer the best rewards on a day to day spending basis. Therefore, I will be limiting its use post-bonus. I will reevaluate the card a year from now when the $89 annual fee comes due.

Reason 3: Timing of Bonus Points

I typically try to plan trips out as far out in advance as possible. While I have followed this path for some of my January London trip, I am lacking on this particular portion and need to book as soon as possible! Fortunately for me, the Barclay Arrival Plus allows the cardholder to purchase now and redeem points to reduce the charge within the next 120 days. That means I can buy my flight the day I receive the card, meet the minimum spend requirement over the next couple months, and then redeem Barclay Arrival Miles for the charge when they post to my account.

This really is something I should have booked earlier in the trip planning process, but this card is one of the few that will still allow me stick to this tight timeline!

Reason 4: Barclays Pulls My TransUnion Credit Report

Credit card applications prompt issuers to pull your credit report from one, two, or all three credit bureaus. A hard inquiry on your credit is what causes your credit to temporarily decrease. Moreover, other credit issuers will be able to see the number of inquiries on your report and a high number of recent inquiries may raise concern.

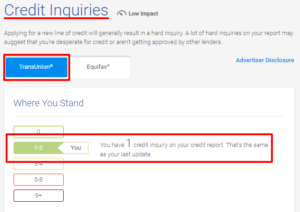

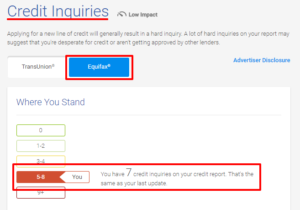

Luckily for most applicants, Barclays will pull your Credit Report from TransUnion. This distinction is important since most other card issuers pull from one of the other two bureaus – Experian or Equifax.

According to CreditKarma, I have only 1 hard inquiry on TransUnion vs. 7 on Equifax!

Barclays pulling your TransUnion report for the Barclay Arrival Plus is to your advantage! The hard inquiry will impact the lesser utilized TransUnion report, and limit the number of inquiries on your other report.

The Application

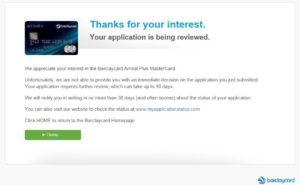

Excited at the possibility of almost $600 in travel credit and achieving a travel goal of mine, I submitted my Barclaycard Arrival Plus application!

And… Pending…

Well bummer! I cannot say that I am surprised, given Barclays has been mighty tough on those who apply for numerous credit cards in a short time frame. I have read various posts noting the tenacity of Barclay reconsideration specialists so I decided to just wait it out, rather than calling.

Finally on Sunday (I applied on Monday earlier in the week), I received a call from Barclays. The specialist asked me to confirm my annual income, verified some additional information, and then BAM! Approved!

I will receive my card in the next 7-10 business days (hopefully sooner so I can book that flight!)

Final Thought

I applied for the Barclaycard Arrival Plus, and with good reason!

Always take the time to determine which credit card offers are right for you and allow your travel goals to drive your points and miles earning strategy! Travel rewards are fun to accumulate, but the real joy comes in redeeming them to achieve your travel dreams!

Looks like I will be getting home from London after all! Thanks Barclaycard Arrival Plus!

Will you be applying for the Barclaycard Arrival Plus under this increased offer?

Happy Travels!

DW

[…] 2. Barclaycard Arrival plus – 50,000 Points […]