Apple has begun rolling out the tech giant’s first-ever credit card. Technically, the Apple Card is still in beta testing making the card somewhat difficult to get. However, last week, I received an invite from Apple to apply for the card.

While I wouldn’t typically apply for a card like the Apple Card, I didn’t want to miss out on the card Apple claims “rethinks everything about the credit card.” So, I accepted the invite and applied for the Apple Card. Now, after a week of use, I’m convinced that the Apple Card has a place in every iPhone user’s wallet. Here’s why.

Applying for The Apple Card

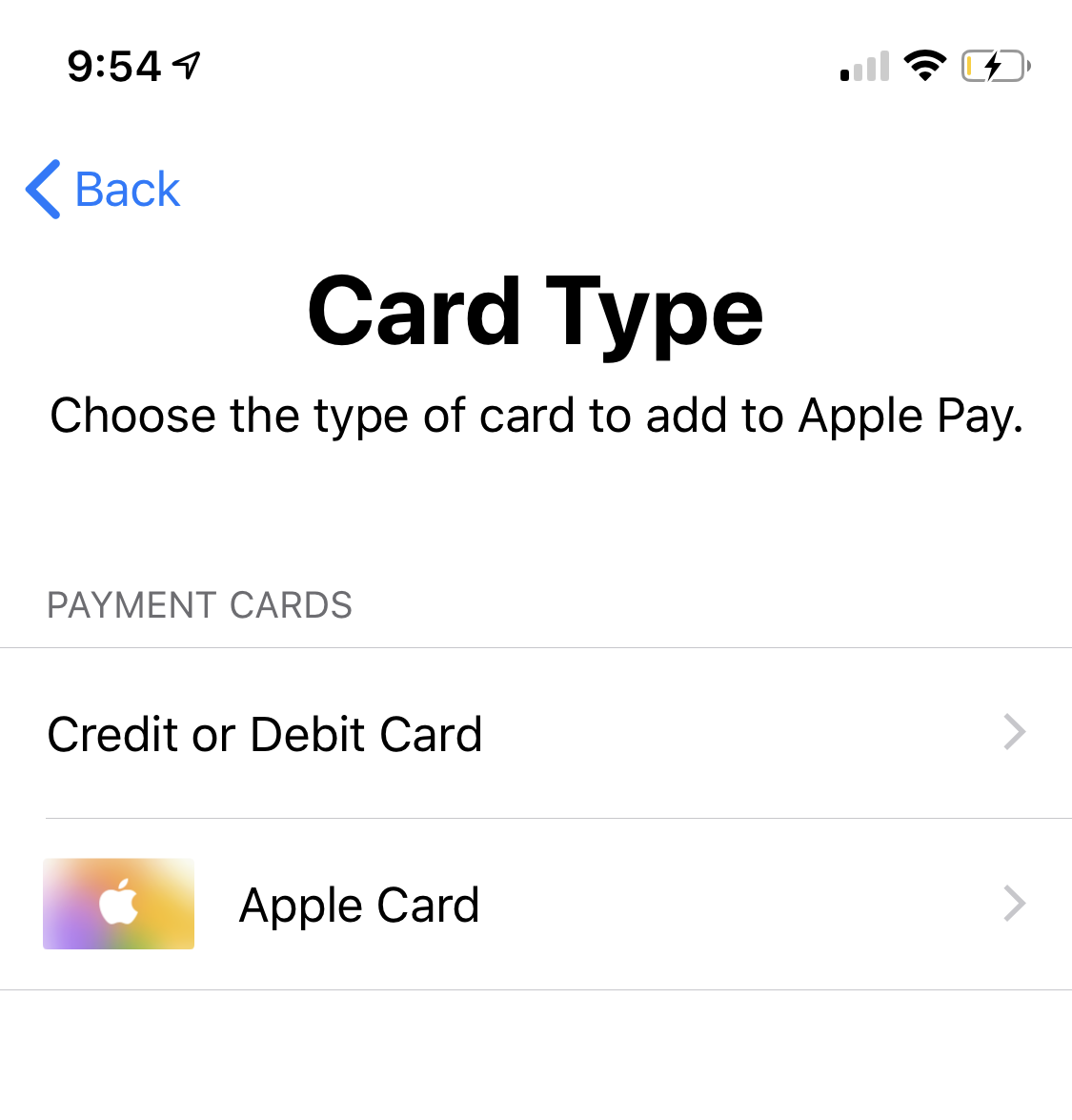

The application process is done entirely via the Wallet/Apple Pay app on your iPhone. It took just three minutes to apply, making it one of the quicker credit card applications I’ve completed. If you’ve been invited to apply, all you need to do is open the Wallet app, select add a card, and select the Apple Card. If the Apple Card isn’t listed as an option, you’ll have to wait for your invitation or for the card to become available to the general public.

- Head to the Apple Wallet app to apply for the Apple Card.

- If you are invited to apply for the Apple Card, it will appear in Apple Wallet when adding a card.

Once I selected the Apple Card option within the Wallet app, the application process began. The first screen of the Apple Card application provides a brief overview of the card and allows applicants to view rates and terms.

The next screen requires applicants to input some personal data. Most of the personal data is pre-filled from your iCloud account. Once you’ve added all required personal info, the next screen submits preliminary information to the card issuer, Goldman Sachs.

Once basic personal information is sent to the card issuer, you’ll likely be asked to submit your photo ID. Applicants are able to submit a copy of their photo ID within the app. Upon submitting a copy of your photo ID, the app sends the rest of your personal information to the card issuer. Within a few seconds, you should have a decision on whether or not you were approved for the Apple Card.

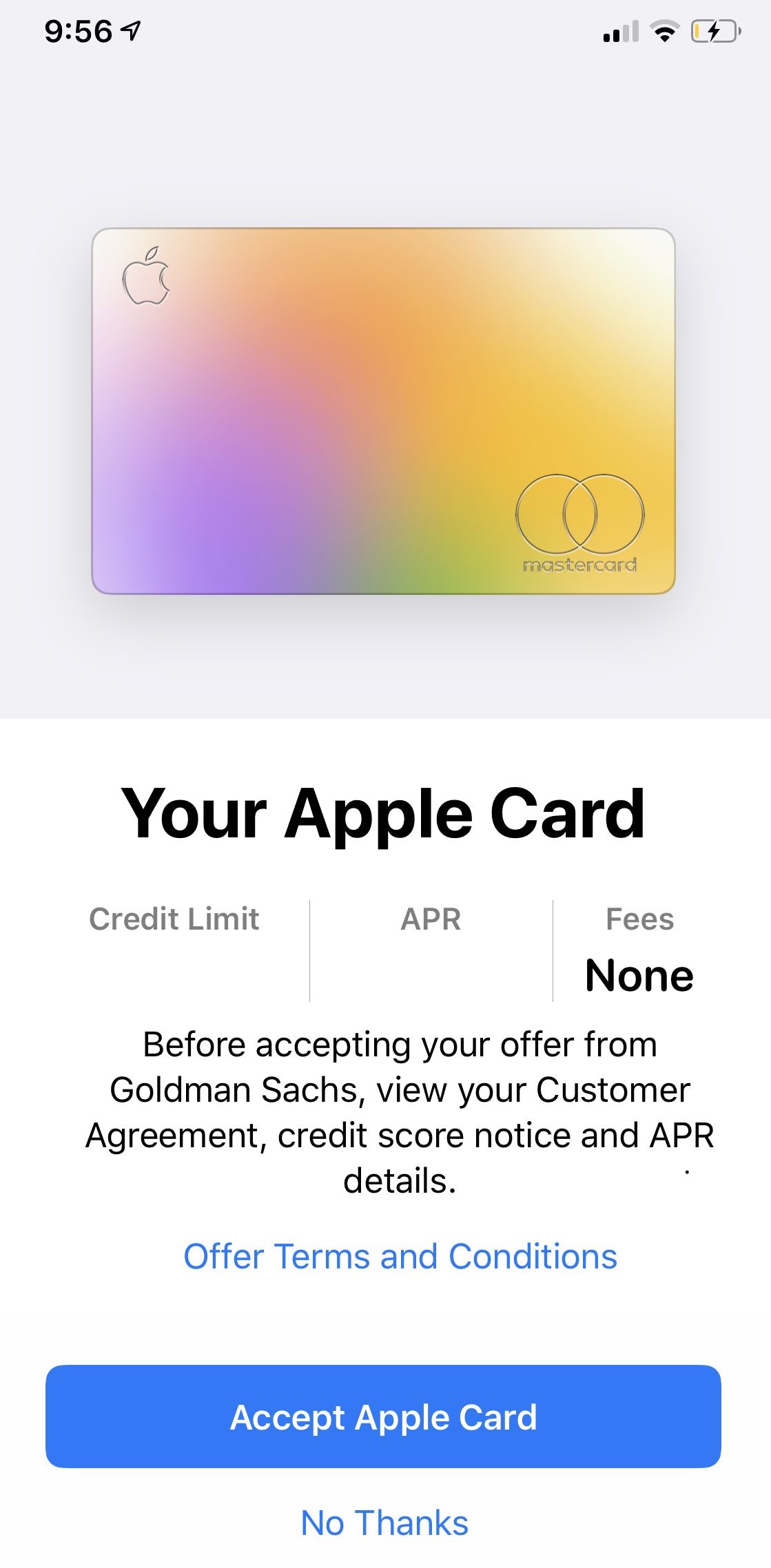

Before you are issued a card, assuming you were approved, Apple allows applicants to view their credit limit, APR, and any additional fees. If you are not satisfied with the results of your application, you can choose to decline the offer and exit the application.

Applicants can first view their offer if approved.

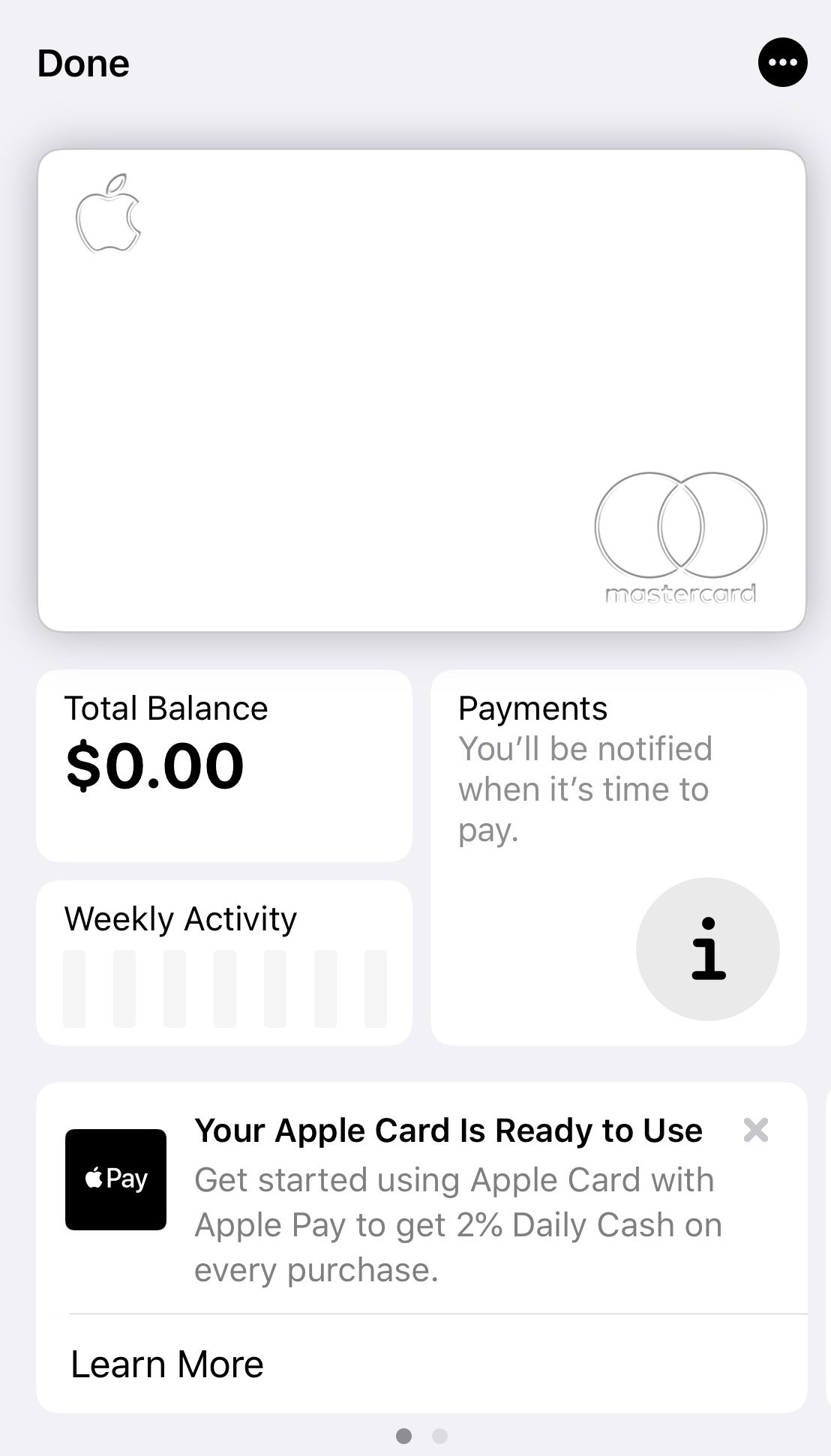

If you accept your offer, you will then be prompted to add the card to your wallet. It’s at this time that you can select to receive a physical card.

I opted to receive the physical credit card. The Wallet app informed me that I would receive my card in 7 to 9 days. Today marks 7 days since I applied and I recently received a notification from UPS that my card is out for delivery and will arrive by the end of the day. If you’re impatient and want to know exactly where your Apple Card is, you can track the status of your card within the Wallet app.

Using My Apple Card

Upon approval, I wasn’t entirely sure what purpose the Apple Card would serve in my wallet. I already have a few preferred cards that earn AAdvantage Miles and American Express Membership Rewards. Additionally, should I want to jump on the cash back wagon, I already have the Discover It card which offers up to 5% cash back on select purchases. However, after two purchases, I began to realize the potential the Apple Card has for the average consumer.

The Apple Card earns Daily Cash at varying rates. The Apple Card earns up to 3% cash back with most users likely earning a consistent 2% cash back on purchases. Additionally, there are no caps on how much cash back you can earn. Here’s how you’ll earn Daily Cash with the Apple Card:

- 3% Cash Back on all Apple purchases

- 2% Cash Back on all purchases made with Apple Pay

- 1% Cash Back on all other purchases made with a physical Apple Card

With nearly all retailers accepting Apple Pay, you’ll essentially earn 2% cash back on most purchases. Since I haven’t received my physical Apple Card in the mail and have been using Apple Pay, I have been earning 2% cash back on purchases made this past week.

While there are other cash back cards that offer 2% cash back, what makes the Apple Card standout is that there is no limit to how much cash back you can earn and how quickly your cash back is made available. Within 24 hours of a purchase posting to your account, you’ll be able to use your cash back.

Daily Cash cash back is instantly transferred to your Apple Cash balance. Apple Cash has been around for some time and is built into the Wallet app. Apple Cash is a lot like PayPal or Venmo. With Apple Cash, you can send and receive money from other Apple Cash users. Now, you can also access your Daily Cash cash back with the program.

Apple Cash can be used anywhere Apple Pay is accepted. Additionally, you can use Apple Cash on iTunes purchases or have your Apple Cash balance transferred to your bank account. Overall, Apple Cash extremely easy to use.

This past week I only spent $80.82 with my card. Still, I racked up $1.62 on those everyday purchases. Additionally, the cash back I earned was transferred to my Apple Cash balance in 24 hours of the purchase posting to my account.

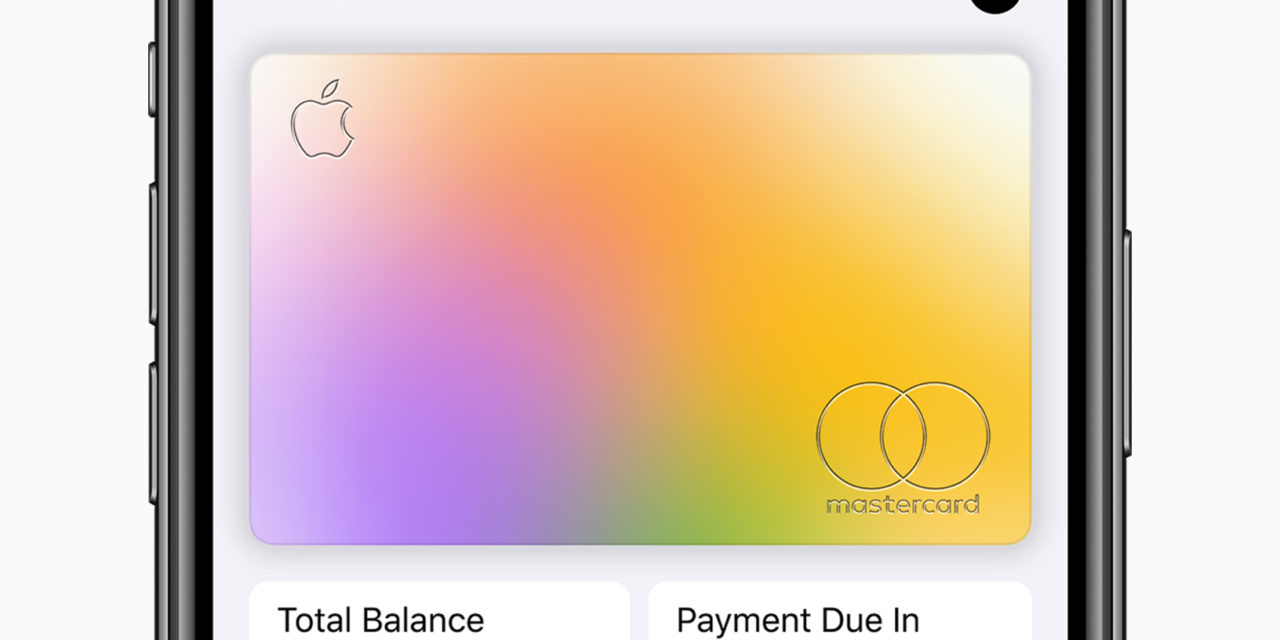

Another thing I liked about the Apple Card was the user interface. It’s super easy to navigate and very informative. Within the Apple Wallet app, you can view all transactions. When you select an individual transaction, you can see on Apple Maps where the purchase was made and how much cash back you’ll earn.

Additionally, all payments are handled through the Apple Wallet app. This makes managing your Apple Card account extremely easy and stress-free.

Bottom Line

Initially, I wasn’t sold on the concept of the Apple Card. I assumed it was just another cash back card with Apple’s glitzy marketing. And yes, that’s exactly what it is. However, I greatly underestimated the cash back earning potential of the Apple Card. Additionally, the simple user interface that Apple has been plugging since the launch of the Apple Card is actually a standout benefit of the card. Though I don’t plan on using this card all that much, it will become my go-to card for all Apple purchases as well as some everyday purchases other cards only earn 1% cash back or 1 point per dollar spent.

Other Posts from Max

- Review: My First Time Flying Intra-European Business Class

- Testing The Benefits of The American Express Concierge

- Preview: Checking Out The United Polaris Lounge at SFO

- This Is What It’s Like to Fly on The Russian-Built Sukhoi Superjet

Waiting for my Iphonw11 to come delivery

So purchasing an airline ticket online… results in 1% cashback?

Unfortunately, yes, it would appear so. More details released today with the card released to the public. Just to clarify, not a great travel card but a pretty solid cash back card.