In a world dominated by chips, magnetic strips and plastic rectangles, it’s easy to take the convenience and security that comes with credit cards for granted. Personally, I have not taken that convenience and security for granted. I’m on a tight leash when it comes to my use of my credit cards. If I lose them, I’m not allowed to get a replacement. Similarly, if I abuse the generous spending limits, the cards will be shredded, burned, and the remaining ash will be dumped into the Mississippi River. Of course, there were additional terms and conditions that came when I was granted access to my parents’ credit cards.

Over the past few months, I’ve been careful not to abuse my privileges and while on the road, I have benefited immensely from the perks, convenience, and security of having credit cards. Bare in mind, there have been a few drawbacks. As well as convenience and security, there are quite a few additional perks that come with having a credit card as a teenager. So, does that mean you should get your kid a credit card?

Over the past few months, I’ve been careful not to abuse my privileges and while on the road, I have benefited immensely from the perks, convenience, and security of having credit cards. Bare in mind, there have been a few drawbacks. As well as convenience and security, there are quite a few additional perks that come with having a credit card as a teenager. So, does that mean you should get your kid a credit card?

No Clear Cut Answer

Sorry Mom or Dad, there’s just no clearcut-simple answer to the question, “Should I get my kid a credit card?” It’s a little more complex than a yes or no answer. It has a lot to do with rather or not they would benefit from the card and if they’re mature enough to take on that responsibility. There have been days that I question my parents’ decision to give me a credit card. I still believe (and so do my parents) that allowing me to have my own credit card was a pretty good decision.

Before I go any further, I’d need to reiterate what I mean by, “their own credit card.” If you were present your child with a credit card and they are under the age of 18 (and 16 or older), they will be added to your account as an authorized user or authorized spender. Essentially, they take your credit score, your outstanding debt, and points or miles. They will have the same spending power as you would, however, their name will be on the card, not yours. Once they turn 18, you can choose to add them as an authorized account member. Then, they will have the ability to link bank accounts, add authorized users, make payments, and alter their own credit score.

Already, you might be asking yourself, “how does this benefit me?” In short, it really doesn’t. It really only benefits your child. Credit cards don’t just allow your kid to have an outrageous amount of spending power. They also affect their credit score, teach them the importance of credit, and give them a very convenient and safe way of paying for essentials.

It Affects Their Credit Score

I’ve read online about co-signed credit cards and I don’t recommend them. A co-signed credit card is not the same as adding your child as an authorized user. I’m not going to go into the details of a co-signed credit card for two reasons: one, it’s not smart to open a co-signed card and two, I’m not aware of any major card issuer offering co-signed cards.

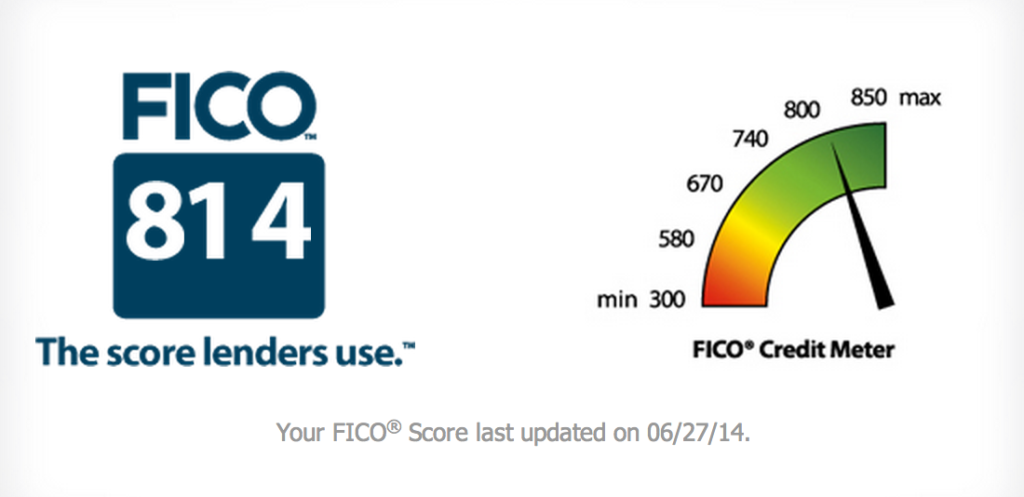

With that said, if you add your child as an authorized user, they will inherit your (and other authorized account holders’) credit score for the duration of the time they’re an authorized user. For example;

- I’m an authorized user on an Amex account

- The account owner’s credit score is excellent

- When I turn 18 and look to get a car loan or open my own credit card

- I WILL INHERIT THEIR CREDIT SCORE!

As a CBSNews article put it, “your child will piggyback on your good payment history.”1 If you have a pretty favorable credit score, this perk will benefit your child (and you) immensely in the not-so-far-off future. I’d advise against adding your child as an authorized user if your credit score isn’t very good unless you hate your kid. If you hate your kid, add them as an authorized user so they can suffer from your poor credit score. If you don’t hate you kid, don’t add them as an authorized user if your credit score is crappy.

Teaches Them the Importance of Credit

If you add them as an authorized user, don’t shelter them from your account summary. Consistently present them with your account summary and of course, their account summary. By age 16, teenagers are beginning to understand the value of money. If they’re mature, they will immediately recognize when they’ve spent too much. If they continue to overspend even after being presented with a large credit card bill, cut the card; your kid isn’t ready for a credit card if that’s the case.

Over the few months I’ve had a credit card, I’ve begun to understand just how serious credit is. I’ve already begun to research how I can raise that three digit number my adult life depends on. In a sense, I’m better prepared than my friends when it comes to the importance of credit and credit scores.

Convenient and Safe Way to Pay

This is probably the least important factor of the three I’ve outlined. A debit card is just as secure (if not more secure) and it’s just as convenient. However, if your child is away from you and/or your spouse for extended periods of time (like me), a credit card is much more practical than a debit card. It’s also nice to have for gas, groceries, and fast food. There are some things I don’t have to pay for while I live under my parents’ roof and with a credit card, I don’t have to worry about my checking account balance.

I also use my American Express Gold Card to access the Centurion Club and to use airline kiosks to print boarding passes and check bags. That same Gold Card allows me to check into hotels without having the security deposit withdrawn from my checking account. There are a number of other scenarios in which a credit card is beneficial but I will save you the time.

I understand that you’re probably still on the fence about getting your kid their own credit card and you should be. It’s a pretty big gamble. It could raise their credit score, teach them a lesson they’ll need later in life, and help them when they travel or by groceries. However, they could also lose the card, overspend, or cause your account to be compromised through misuse.

In my case, the pros outweighed the cons. Of course, that won’t be the case for every teenager out there. If your child has requested you get them a card or you’ve personally considered getting them a card, the best thing to do would be to draft as “Pros and Cons” list. Pros and cons will differ from card to card and family to family. The most important cons to note is the possibility to additional annual fees and a child’s lack of maturity. The most important pros to note are benefits to your child’s credit score and the security of allowing your child to carry a convenient form of payment.

Additional Notes-

1 CBSNews; “4 ways to help kids establish credit”,http://www.cbsnews.com/news/4-ways-to-help-kids-establish-credit/