Premise

Accor Hotels, a French hotel group, continues its expansion by acquiring Travel Keys. Travel Keys is a broker representing over 5,000 in 100+ worldwide locations. This will expand Accor’s luxury villa and property offering, to about 8,500 properties. Accor recently acquired FHRI Hotels & Resorts, which owns the Fairmont, Raffles, and Swissotel chains. This most recent acquisition continues to build Accor’s luxury offerings for higher-end consumers, and will complement its current onefinestay and Squarebreak brands. Should all go to plan, the deal will close in Q2 2017.

Accor Synergies from acquiring Travel Keys

This acquisition makes plenty of sense for a company looking to corner the luxury private rental market for several reasons.

Revenues

First of all, this deal adds the Travel Keys database of luxury rentals to Accor’s existing onefinestay and Squarebreak portfolios. Maybe it will improve the combined value through cross-selling and having more properties and critical mass, pushing it higher in a consumer’s mindset. Additionally, this will expand the range of customer and regions of properties that Accor offers. Additionally, more company-specific revenue synergies could include stronger negotiation power with retailers or businesses close to the villas. For example, if a city had only one property, Accor may not be able to wrangle a discount on scuba diving or from a restaurant. However, with this acquisition perhaps the same city now has five villas in a small distance. I could see a savvy business owner open to some sort of partnership now to drive more business. This extra revenue stream could be a whole world of business partnership development opportunities.

Costs

Cost reductions are typically a larger share of the synergies realized in M&A. For Accor and Travel Keys, this could include headcount and operations reductions, streamlined / merged corporate activities, best practice sharing, and others. Other cost-saving synergies could be in a service capacity, such as the economies of scale of spreading transportation (taxis, shuttles for guests, etc.) and servicing (maids, cleaning, gardening, upkeep, etc.) across a larger number of properties in the same area.

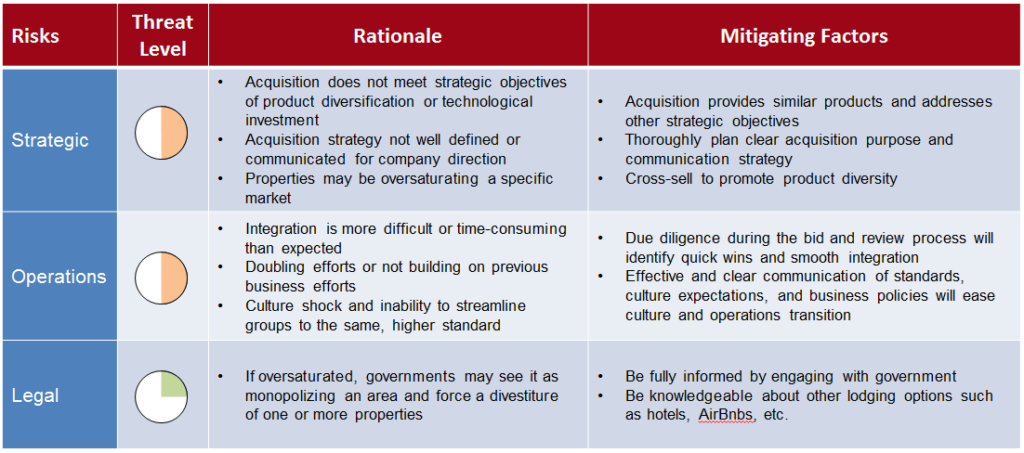

Risks, Mitigations, and Considerations

I’ve crafted a quick chart below highlighting some of the risks, mitigations, and other considerations of this venture for Accor.

Conclusion

I have stayed at an Accor property (the Thousand Dollar Plaza Hotel NYC) not once or twice but three times (Thank you Chase Fairmont and free hotel stays). This acquisition is also in a luxury category, and makes a lot of business sense. I have also stayed in their Novotel brand, which is more of a business-class hotel. Lastly, I look forward to trying these luxury villas someday. While I still love my hotels, I would give Travel Keys a try.

Featured image from Pixabay of a beautiful Villa that I would love to stay in someday! Original acquisition news article is here.

What do you think of my musings and deal analysis? Let me know in the comments, or reach me directly at TheHotelion@gmail.com! Like my posts? See more here, on TravelUpdate! Follow me on Facebook (The Hotelion) or on Twitter and Instagram: @TheHotelion